Demographic Time Bomb: A Hidden Threat to our Economy

Why our thirst for the fountain of youth and current trend of decreasing birth rates could be a recipe for an economic disaster

We human beings are pretty incredible. From the invention of fire to being pretty close to having a sun of our own (nuclear fusion), we have been making breakthroughs after breakthroughs, and all of this piles up and increases the pace of progress.

One of the most fascinating outcomes of this progress is our increasing ability to extend human life (and maybe even immortality is also around the corner who knows).

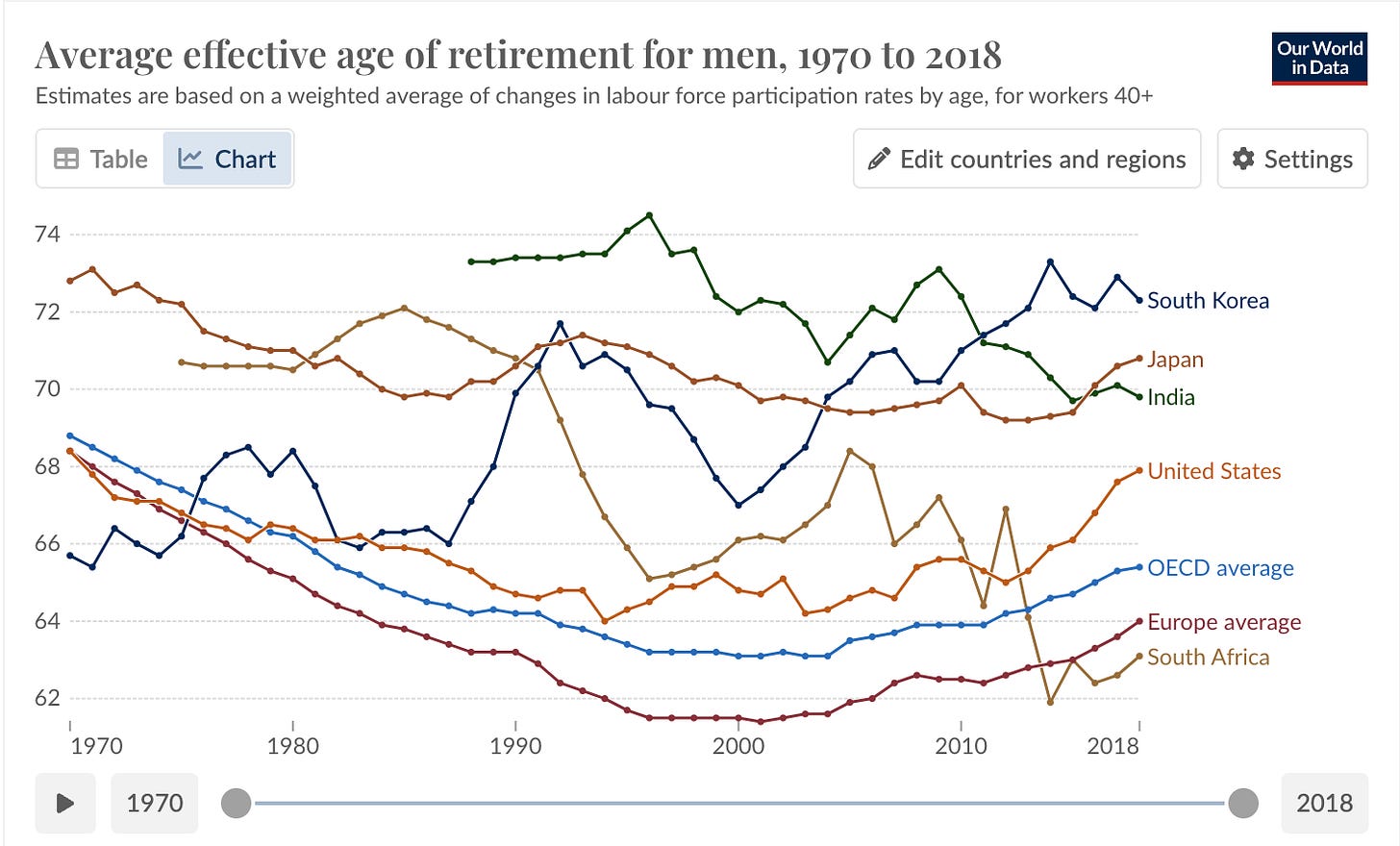

Now I want you to take a look at these two graphs below:

As you can see, we are now living longer but retiring at the same age or earlier. This means you would get more time post-retirement to finish that char-dham yatra, enjoy some morning chai post-walking in the park with your old buddies, babysit your grandchildren, break some silverware at a tavern in Greece, or sip some aperol spritzes by the beach. That is the luxury that human progress grants us. Sounds perfect right?

Well, there is one caveat; but before we dive into that, we first need to look at how a country affords its retirement-age population.

Who pays for your retirement plans?

Savings

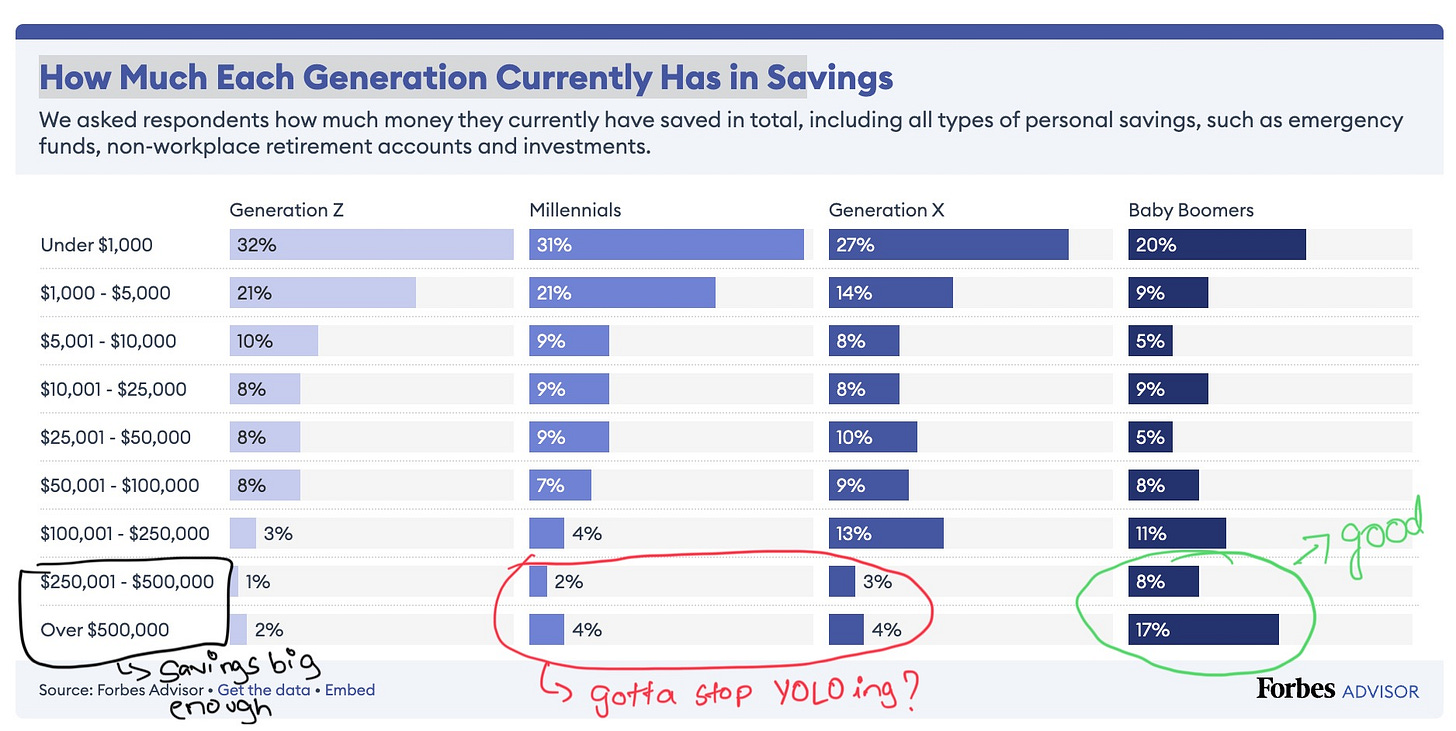

Current retired population is majorly from the baby boomer generation and, they seem to have their finances sorted. A large fraction of them own a house, have very less to no debt, and have substantial savings to splurge on.

For the ones who used to be privately employed, self employed, this savings (including investments) is the main source of funds for their retired life.

Public Transfers ( pensions, healthcare, other old age benefit transfers)

Now, let's talk about the government's role in supporting retirees. In many countries (Europian ones being the foremost), a significant portion of retirement support comes from public transfers. These typically include pensions, healthcare benefits, and other old-age welfare programs.

These public transfers are primarily funded by taxes paid by the current working population. This model, often called a "pay-as-you-go" system, has been a cornerstone of social security in many developed nations for decades.

In some nations, they form the backbone of retirement support, while in others, they're more of a supplement to personal savings and private pension plans or kids paying for parents (not very uncommon in countries like India).

With fast technological advancements and unprecedented productivity gains, we are creating wealth faster than ever. So, supporting those extra retirement years should be a piece of cake, right?

What’s the problem then?

First, let's talk savings. Unlike the current retirees, many of whom are sitting pretty with paid-off houses and savings, future generations might not be as lucky. Stagnant wages, rising living costs, and changing work patterns make it harder for younger folks to save. The piggy bank for future retirees might be emptier than one would like before retiring.

In a CNBC survey of 18-to-34-year-olds last month, 42% said they’re earning more than they were a year ago, versus 27% making less. Yet nearly half said they couldn’t cover more than one month’s expenses if unemployed, and only 11% could do so for a year. Just 32% of Gen Zers and 37% of millennials are comfortable with their emergency savings, a recent Bankrate report found, though their Gen X counterparts felt only slightly better (38%).

Despite her financial pressures, Easmael still spends $300 to $400 a month on fashion, after a 100-pound weight loss boosted her view that “when you look good, you feel good.”

Many young adults are making their own similar calculations about how and when to spend versus save, experts say.

Second, there's another trend we need to consider: declining birth rates.

In any society, there's a sweet spot of ages (roughly 25 to 59) where people typically produce more than they consume. They're the economic powerhouses, paying taxes that fund public services and transfers – including those retirement benefits we talked about earlier.

Now, with people living longer and having fewer kids, this productive age group is shrinking relative to the overall population. This shift puts pressure on public transfers, as they're primarily funded by taxes from this increasingly outnumbered group of prime-age workers.

According to projections, the support ratio (number of workers per consumer) is expected to drop significantly in many countries. By 2050, we're looking at potential consumption drops of 25% in China, 9% in the US, and 13% in other high-income countries – unless we find ways to boost labor supply or adjust our consumption patterns.

While the future remains uncertain, these demographic trends need attention. Developed countries will likely face these challenges first, but developing nations may follow as they progress. The severity of the issue will depend on how population aging unfolds and how well policies adapt. Some governments are already taking steps, like adjusting retirement ages and benefit structures.

But what do you think your country should do? Share in the comments!