From Matcha in Manhattan to Masala Chai in Mumbai: The Global Spending Olympics

Every economy has its powerhouses, the ones who keep the global cash register ringing. And when it comes to spending, the usual suspects step right into the spotlight: the United States, China, Europe

Let’s break it down, not with economic jargon but with real-world money talk.

GDP, Incomes, and What That Means for Spending

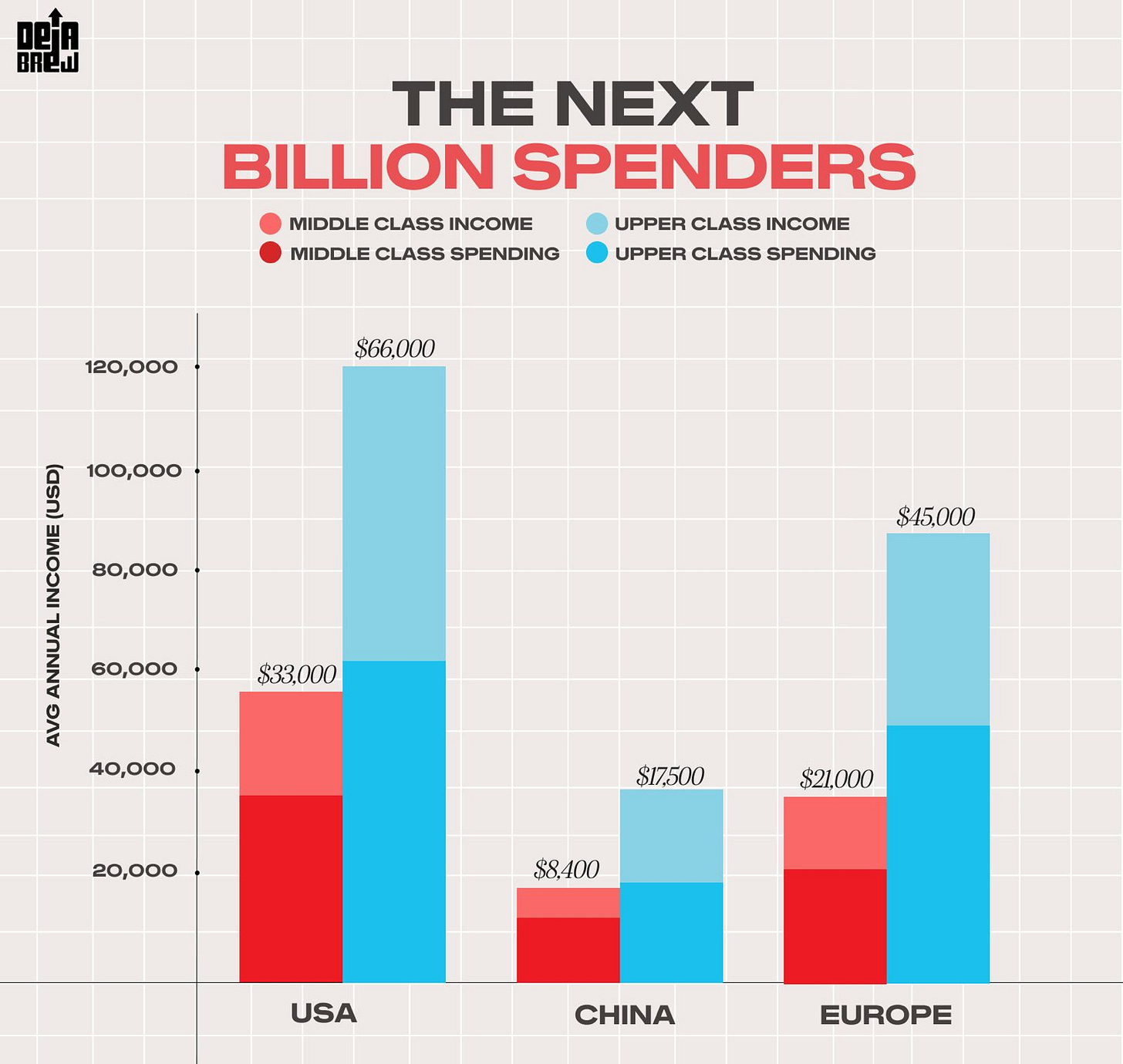

USA: With a GDP of over $28 trillion, it is not just a high-output economy; it’s a spending machine. The middle-class income here hovers around $70,000/year, while the upper class easily crosses $200,000/year. On average, around 65-70% of that income flows into consumer spending from iPhones to iced matcha lattes, from Nike drops to Netflix subscriptions.

Multiply that across over 100 million households, and you're staring at a consumption volcano that erupts with trillions of dollars every year.

Europe isn’t far behind, with a combined GDP of ~$20 trillion. The average middle-class income sits a bit lower than the U.S. (say $40,000–$60,000/year, depending on the region), and their spending habits are a bit more conservative (about 50-60% of income), but thanks to a population of over 450 million, they still clock in a massive consumer base.

Then comes the dragon: China.

With a GDP of ~$17.5 trillion and a rapidly expanding middle and upper class, China has gone from the factory of the world to the market of the world. Incomes in urban China range from $15,000–$30,000/year for the middle class and upwards of $60,000 for the upper middle class.

Despite lower income levels compared to the West, consumer spending is fierce, driven by a culture of prestige, tech adoption, and status signalling.

Spoiler alert: China now spends more in total than the U.S. in several key consumer categories.

coming to: https://x.com/coldasbarf/status/1942593751907778876?s=61

The Gender Gap in athleiusre trends picking up from the west

Despite rising female affluence and fitness awareness, participation in these spaces is skewed. Whether it’s a sunrise run club in Bandra or a weekend pickleball match in Gurgaon, these arenas are still largely male-dominated.

This reflects a broader cultural pattern: women in India face persistent barriers to entry in recreational sports, ranging from a lack of safe spaces and social support to limited role models. Even athleisure advertising often focuses on aesthetics, not athleticism.

In India, girls are often nudged toward being “presentable” rather than “active.” Sports is still subconsciously framed as a masculine pursuit. So even when women buy athleisure, it’s often for looks, not for performance. That messaging starts young and runs deep.

Boys = encouraged to roughhouse, join teams, take space.

Girls = told to be careful, look nice, stay within limits.

1. Commercialisation Skews to the Male Gaze

The athleisure industry says it markets empowerment but the aesthetics still centre on what men want to see rather than how women want to move.

Ads = toned abs, seductive poses, matching sets rarely show sweating, team sports, or joy.

Brands sponsor male athletes or neutral-fit influencers, rarely raw female performance or grassroots sports stories.

Product design often assumes male proportions or comfort preferences.

It’s not just about leggings, it’s about the stories being sold alongside them.

2. Lack of Role Models and Visible Female Communities

For every 10 sports influencers in India, 8 are male. The pipeline of visible, vocal, and community-building women athletes is still nascent.

We don’t yet have the Indian equivalent of a Serena Williams x Nike movement-based campaign.

Run clubs are forming, but they’re still elite, metro, English-speaking, and often skew male.

Community spaces like Bumble’s “Rundowner” are early steps—but not widespread or intersectional.

This creates a loop: low visibility → low participation → low support → repeat.

3. Emotional Labour and Time Poverty

A woman might have the will and even the money, but not the time.

Who handles unpaid domestic work? Still mostly women.

Who has the flexible schedules for 7am sports clubs or 9pm games? Usually not mothers or working-class women.

If men go play pickleball after work, it’s “networking.” If women do it, it’s “selfish.” That double standard is real.

So what’s the fix?

Brands need to go beyond performative campaigns and fund safe, inclusive sport spaces.

Communities need to centre visibility for women-led athletic initiatives.

Infra must change: from better street lighting to female-only gyms and coaching programmes.

Narratives must evolve from looking fit to being strong.

This conditioning doesn’t disappear just because there’s a fancy run club or a gym in every metro.

The Data

Pickleball players in India grew 159% between 2019 and 2022, with 60,000 active players and over 100,000 casual participants by 2024. But women form a small fraction. [Source: AIPA, LiveMint, The Hindu BusinessLine]

Run clubs inspired by Nike’s “After Dark Tour” or Bumble’s “Rundowner” are emerging in metros, but tend to skew male, especially in early-morning time slots and elite neighbourhoods. [Source: marketing reports, brand campaign data]

Picking Pickleball and running clubs

Pickleball is now part of the recruitment offer: companies are finding partners to provide pickleball, running and other fitness activities to attract and retain employees (Live Mint).

The number of pickleball players in India grew by 159% between 2019 and 2022, mirroring global trends.

By late 2024, India had about 60,000 active players, with nearly 100,000 having played at least once

The sport’s global boom, especially in the US, where it became popular post-2020 and attracted celebrities like Serena Williams and LeBron James, helped fuel its aspirational appeal in India. Indian promoters, inspired by the sport’s Western success and visibility, leveraged these influences to attract sponsors, organise leagues, and secure media coverage

Run Clubs Modelled on the West

Indian run clubs are modelled after Western ones, focusing on group runs, social events, and brand tie-ups: think Nike’s “After Dark Tour” or Bumble’s “Rundowner” collabs

India’s consumer market is set to be the world’s third-largest by 2026, just behind the US and China.

There’s a massive surge in the “affluent” crowd (people earning $10k+ a year), expected to double to 88 million by 2028. That’s a lot more people with money to spend on cool, global brands

Matcha as a disruptor of the indian coffee market

Matcha, once a niche Japanese import, is now booming in India, especially among urban millennials and Gen Z who want clean energy, wellness, and Instagrammable drinks.

The Indian matcha market is expected to grow from $104 million in 2024 to $167.8 million by 2030 at a strong 8.6% CAGR, outpacing many traditional beverage segments

How Matcha Is Shaking Up Coffee Culture

Matcha offers a unique value: it delivers a gentler, longer-lasting energy boost (thanks to L-theanine) and 137x more antioxidants than regular green tea

Indian consumers are now ordering matcha lattes, smoothies, and even matcha desserts at cafés, inspired by global wellness and café culture.

Social media and global pop culture have made matcha aspirational, pushing brands to innovate with instant premixes and ready-to-drink options

Twitter user avgspacelover says, pickleball is the match of sports and it rings a bell with both the references above.

Our two cents:

In the end, GDP isn’t just a number economists obsess over, it’s a mirror to how nations live, spend, and flex. The U.S. may lead with high incomes and an unmatched culture of consumption, but Europe brings scale with steady habits and social security cushioning the spend. Meanwhile, China’s consumer engine is revving faster than ever, proving that spending power isn’t just about income, it’s about ambition, aspiration, and a little bit of status signalling.

So whether it’s a $6 oat milk latte in Brooklyn, a Zara haul in Barcelona, or a Xiaomi gadget in Beijing, how people spend tells you everything about where the world’s headed next. And right now, the race isn’t just who earns more, it’s who spends smart, scales faster, and shapes culture.

Welcome to the era of Consumption Capitalism.

Good read