How is it cheaper to fly from London to Paris than from Kolkata to Mumbai?

Flying within India can be pricier than crossing borders in Europe

Air travel has transformed global connectivity, making distant lands accessible within hours - letting you attend the Coldplay concert in UAE when your queue number for the shows in India has more than 5 digits. In regions like Europe and the Americas, the proliferation of budget airlines has “democratized” flying, turning it into a commonplace mode of transportation for many. In contrast, India—a nation with a burgeoning middle class and vast geographical expanse—still grapples with comparatively high airfare prices. This raises a pressing question: why are flights in India so expensive relative to their Western counterparts?

In today’s edition of Deja Brew, we delve into the multifaceted factors contributing to this phenomenon, exploring competition, government policies, airport incentives, consumer behavior, and the history of budget airlines in India.

India's journey with budget airlines has been tumultuous. The concept of low-cost carriers (LCCs) began with Air Deccan in 2003, aiming to make flying affordable for the masses. Despite its initial success, Air Deccan struggled with financial viability due to high operating costs and was eventually acquired by Kingfisher Airlines.

But doesn’t India have Low Cost Carriers?

India has what the developed world would think of as low cost carriers but that is still incomparable to fares offered by airlines like Ryanair. India is in need of Ultra-Low-Cost-Carriers.

What’s the difference?

Ultra-Low-Cost Carriers (ULCCs) and Low-Cost Carriers (LCCs) both focus on offering affordable air travel, but they differ significantly in their approach. ULCCs take a bare-bones approach, offering the lowest possible base fares by unbundling almost every service. Passengers pay extra for seat selection, carry-on bags, checked luggage, and even basic conveniences like boarding passes, allowing travelers to customize their experience while keeping costs down. LCCs, on the other hand, include a bit more in their base fares, such as carry-on bags or seat assignments, and tend to have fewer add-on fees. ULCCs target highly price-sensitive travelers, often on shorter routes, while LCCs appeal to budget-conscious flyers looking for a balance of affordability and convenience. Revenue for ULCCs comes heavily from ancillary fees, whereas LCCs rely more on a mix of ticket sales and fewer extra charges. Examples of ULCCs include Spirit Airlines and Ryanair, while Southwest and JetBlue represent LCCs that offer slightly more inclusive experiences.

Market Competition and Industry Dynamics

Competition is a critical driver of pricing in the airline industry. In Europe and the Americas, a plethora of airlines vie for market share, leading to competitive pricing strategies. Carriers like Ryanair, EasyJet, Southwest, and JetBlue have disrupted traditional models by offering no-frills services at minimal costs.

In India, however, the market dynamics differ significantly. The airline industry has seen the exit of major players like Kingfisher Airlines and Jet Airways due to financial distress. This consolidation has led to a market dominated by a few key players—IndiGo, SpiceJet, Air India, and Vistara—with IndiGo holding the lion’s share in the Indian airline industry.

This oligopolistic structure diminishes competitive pressures that typically drive down prices. With fewer players, there is less incentive for aggressive price competition, allowing airlines to maintain higher fare structures.

While Akasa Air, brainchild of the legendary investor Rakesh Jhunjhunwala, does offer a glimmer of hope amidst sky-high (haha) ticket fares, it remains fairly pricey for the time being.

Government Policies, Regulatory Environment & Fuel

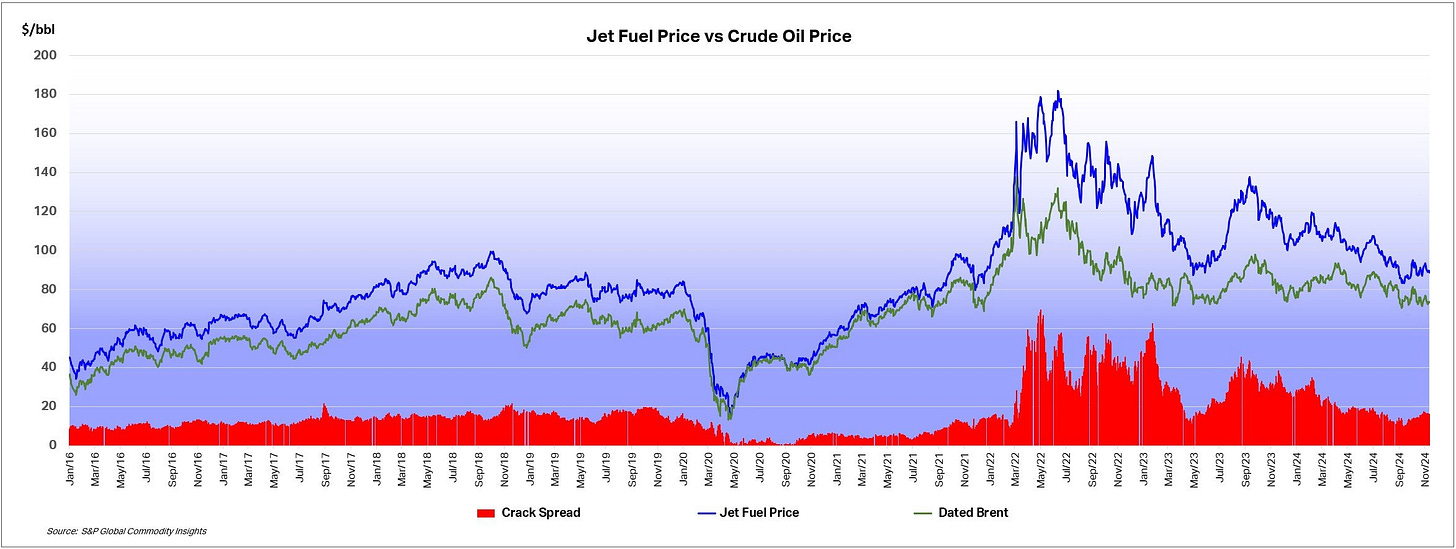

Government policies profoundly impact the operational costs and pricing strategies of airlines. In India, the aviation sector is subject to stringent regulations and high taxation. One of the most significant burdens is the taxation on Aviation Turbine Fuel (ATF). Unlike many countries where jet fuel is either exempt from taxes or taxed minimally, Indian airlines face high state-level taxes on ATF, sometimes exceeding 30%. Since fuel costs constitute a significant portion of an airline's operating expenses, these taxes directly inflate ticket prices.

Additionally, the Indian rupee's volatility against the US dollar affects airlines since many expenses, including aircraft leasing and maintenance, are dollar-denominated. Fluctuating exchange rates can significantly impact operating costs, making it challenging for airlines to maintain stable pricing.

Moreover, regulatory policies like the erstwhile 5/20 rule—requiring airlines to have five years of domestic operations and a fleet of at least 20 aircraft before flying internationally—have historically hindered new entrants from expanding and achieving economies of scale. Although this rule was relaxed in 2016, the legacy effects linger, affecting the industry's competitive landscape.

"In reality, the operating environment makes it very difficult to be genuinely low cost," says a Centre for Asia Pacific Aviation (CAPA) report.

The Ministry of Aviation has introduced price caps, stipulating that airlines could not charge passengers less than Rs 2,900 (excluding GST) or more than Rs 8,800 (excluding GST) for domestic flights lasting less than 40 minutes. These lower caps aimed to protect financially weaker airlines, while the upper caps aimed to safeguard passengers from exorbitant fares.

While a price ceiling is understandable in a country like India to prevent predatory pricing—similar to concerns raised after last year’s train derailment case in Odisha—the price floor seems counterintuitive for passengers. It restricts airlines from offering cheaper fares, limiting affordability for people like you and me and to go and watch the Coldplay concert (yes I am still salty about it).

Airport Infrastructure and Associated Costs

Airport infrastructure and the costs associated with it play a pivotal role in determining airfare. Indian airports, particularly major ones like Delhi, Mumbai, Kolkata and Bangalore, charge high landing, parking, and ground handling fees. These charges stem from the need to recover investments made in modernizing airport infrastructure. In contrast, budget airlines in Europe often operate from secondary airports with lower fees and quicker turnaround times, enabling cost savings that are passed on to consumers.

While India is likely to become the third largest aviation market in the world soon (after China and the US), infrastructure development is considered the major challenge (IATA, 2018).

~ Czerny, A. I., & Lang, H. (2019). Privatization and deregulation of the airline industry. Hong Kong Polytechnic University.

Additionally, India's airport infrastructure faces capacity constraints. Congestion at major airports leads to delays and increased operational costs. The lack of sufficient regional airports limits the ability of airlines to open new, potentially profitable routes that could lower overall costs through increased utilization.

Thankfully, India has an ambitious plan to expand its airport infrastructure to 300 airports by 2047. With passenger traffic projected to rise from 376 million to 3–3.5 billion annually, smaller airports are essential for decongesting major hubs like Delhi and Mumbai, which are already operating at capacity. They enable regional connectivity, allowing Tier-II and Tier-III cities to access national and international markets, driving economic inclusivity and development. Smaller airports are also crucial for supporting the government’s UDAN initiative, making affordable air travel accessible to underserved regions and bridging the urban-rural divide.

However, challenges such as underutilization, insufficient infrastructure, and financial sustainability persist. Many smaller airports currently operate below capacity due to limited airline interest or inadequate passenger volumes. Addressing these issues will require a holistic approach, including incentives for airlines, private-sector participation, and tailored infrastructure investments. AAI’s flexible and phased approach, emphasizing adaptability to evolving needs, offers a pragmatic path to integrating smaller airports into India’s aviation ecosystem, ensuring they drive growth and inclusivity while meeting the demands of a rapidly expanding passenger base.

Consumer Behavior and Market Demand

Consumer behavior in India also influences airfare pricing. There's a strong preference for full-service carriers that offer additional amenities, even at higher prices. Cultural factors, such as the importance placed on hospitality and service, mean that consumers may prioritize comfort and service quality over cost savings.

Furthermore, demand for air travel in India is highly seasonal, peaking during festivals, weddings, and holiday periods. Airlines capitalize on this surge by increasing fares, a practice sustained by consumers' willingness to pay premium prices for timely travel during significant life events.

Airport Incentives and Operational Challenges

While major airports like Delhi, Mumbai, and Bengaluru showcase impressive hardware, they fall short in "software"—management practices that ensure seamless operations. Passengers frequently face long delays at check-ins, security screenings, and baggage collection, often needing to arrive hours in advance to avoid missing flights.

These inefficiencies stem from inadequate management incentives, as airports operate as regulated monopolies. Their revenue depends on landing fees, passenger service fees (PSF), and user development fees (UDF), with little emphasis on service quality. Passengers are forced to rely on road transport, increasing travel time and congestion, as most airports lack public transport options, except for Delhi and Chennai, which are connected to the main city by metro.

The lack of airport incentives exacerbates these issues, impacting not only passenger experience but also airline costs and connectivity. In many countries, airports offer financial incentives, such as reduced fees or marketing support, to airlines for launching new routes or increasing traffic. Indian airports, however, rarely provide such measures due to financial pressures and the need to recover large infrastructure investments. Combined with outdated air traffic management systems, restricted night operations at certain secondary airports, and airspace limitations, airlines incur higher operating costs. These costs, in turn, are passed on to passengers in the form of higher ticket prices.

To bridge these gaps, India must prioritize both operational efficiency and strategic expansion. However, alongside expansion, there is an urgent need to introduce management reforms that emphasize data transparency and accountability. For instance, airports could publish daily performance metrics such as average wait times, baggage handling delays, and the percentage of passengers missing flights. Such data, common in many global airports, would foster competition and drive improvements in service quality. Additionally, introducing financial incentives for airlines to operate new routes and optimizing ground and airspace operations could transform India's aviation ecosystem. By addressing these challenges, Indian airports could align with global standards, enhancing passenger experiences while driving growth in the aviation sector.

Disembarking Thoughts

The growth of budget airlines in Europe and the Americas demonstrates how well-designed policies and strategic practices can revolutionize air travel. Their success is built on three pillars:

- Open Skies Policies: Liberal aviation policies promote competition and allow foreign carriers to operate freely, increasing options for consumers and driving down prices.

- Efficient Use of Secondary Airports: Budget airlines often use smaller, less congested airports with lower fees, reducing operational costs.

- Lower Taxation on Fuel: Reduced taxation on jet fuel in these regions decreases one of the largest operating expenses for airlines.

In contrast, India's aviation sector faces a challenging environment shaped by limited competition, high operational costs, and restrictive government policies. These factors hinder the development of a thriving low-cost aviation market that could benefit the broader population.

India needs to address these challenges with a multifaceted strategy. Leveraging secondary airports, many of which are underutilized or poorly equipped, could ease congestion at major hubs like Delhi and Mumbai while reducing operating costs. Upgrades to handle narrow-body aircraft and improved connectivity to these airports are essential for regional integration. Finally, reducing high jet fuel taxes, a major expense for airlines, would help lower ticket prices and make air travel more affordable.

Indian airports often fall short in providing a seamless passenger experience, with delays at check-ins, security, and baggage collection adding significant overhead to travel times. Adopting data-driven management practices could transform this scenario. Publishing daily performance metrics—such as wait times, baggage delivery times, and the percentage of passengers missing flights—would not only improve transparency but also foster healthy competition among airports.

Moreover, incentivizing airlines to operate new routes and improving airspace management would benefit not just passengers but also airlines struggling with high operational costs.

A concerted effort to align policies, streamline operations, and enhance transparency is essential to create a vibrant and accessible aviation sector. This transformation will require collaboration between the government, industry stakeholders, and consumers to realize the full potential of India’s aviation industry.

And just in case you missed out on the last edition of Deja Brew - we brewed something worth reading: