Real Estate Realities: India’s Boom and China’s Bubble

To buy, or not to buy: that is the question.

Welcome to this edition of Deja Brew, where we delve into the pulsating world of real estate. Today, we explore two contrasting narratives shaping the property markets in Asia: India's recent real estate boom and China's burst property bubble. Buckle up as we explore how these contrasting narratives are reshaping the global real estate landscape and what they might mean for the future of property investments.

In this issue, we’ll unravel why India is currently a hotspot for real estate investment, driven by government reforms and a surge in NRI (for the uninitiated - Indians settled abroad ) interest, while also addressing the challenges it faces, like rising property prices and regulatory hurdles. On the flip side, we’ll take a brief look at China’s real estate bubble—its rise, collapse, and the lessons that India can learn to avoid similar pitfalls. Whether you’re an investor, a policy maker, or just curious about the property market, this deep dive will provide you with valuable insights to mingle with people interested in real estate.

The Indian Real Estate Boom: An Overview

India has become one of the world’s most attractive real estate investment destinations. Both residential and commercial real estate has been growing at never before seen rates propelled by steady economic growth, correct governmental reforms, and an influx of international investors.

What Have the Policy Makers Got Right?

Policies such as the Real Estate (Regulation and Development) Act (RERA) and the Pradhan Mantri Awas Yojana (PMAY) have bolstered investor confidence and incentivized affordable housing projects. RERA aims to bring transparency and accountability to the sector, while PMAY provides subsidies for homebuyers in the lower-income brackets.

Initiatives like the Affordable Housing Scheme and the Smart Cities Mission(SCM) have further enhanced the appeal of Indian real estate. While the ambitious target of 100 smart cities by 31st March 2025 might not be achieved, 90% of the total projects are done.

Initially inspired by global urban trends, the SCM aimed to develop 100 cities through a mix of redevelopment, retrofitting, and greenfield projects, with an emphasis on ICT-based solutions. Despite a significant budget and a public-private partnership model, the mission has faced criticism for being misaligned with local urban realities, exclusionary in its scope, and poorly integrated with existing governance structures. Despite all of this, the SCM has spurred numerous initiatives that have contributed to the modernisation of urban infrastructure in India which in turn has led to an increase in investments even in tier 2 and tier 3 cities.

Recently, the cabinet approved the setting up of 12 industrial smart cities, alongside the 8 which are already in construction, across 10 states. This move is expected to bolster the already lucrative real estate sector.

The Non Resident Indians Want to Buy a Home Where the Heart is (back in India)

India's real estate market is not only a hotbed of activity for domestic investors but also a prime destination for Non-Resident Indians (NRIs) looking to invest where their roots lie. Despite living abroad, many NRIs are channeling substantial amounts of capital into Indian real estate, driven by both emotional ties and financial incentives.

→ A Surge in NRI Investment

In recent years, rapid urbanization and a burgeoning middle class in India have significantly increased demand for residential properties. This trend is mirrored in the investment patterns of NRIs. In the fiscal year 2021, NRIs invested a remarkable $13.1 billion in Indian real estate, according to 360 Realtors. This substantial investment underscores a strong preference among NRIs to secure property back home, with a survey by Anarock revealing that 71% of NRIs view investing in Indian real estate as their top choice.

→The Impact of the Falling Rupee and The Demand for More Luxury

Research by the Confederation of Indian Industry (CII) and Anarock indicates that NRIs contribute to 10-15% of the homes sold in any given quarter, highlighting their significant role in the market.

The weakening of the Indian rupee has provided a further boost to NRI investments. As the rupee depreciates, it enhances the purchasing power of NRIs, making real estate in India more affordable and attractive.

A noticeable trend among NRIs is the growing preference for larger and more luxurious properties. This shift is partly driven by the increased purchasing power afforded by the depreciated rupee. Many NRIs, especially those residing in the Gulf countries, view these investments as potential future residences, anticipating a return to India.

→Emotional and Practical Motivations

The desire to own a home in India is not just a financial decision but also a deeply emotional one. For many NRIs, investing in property back home is a way to maintain a connection to their cultural heritage and secure a place for future retirement. This emotional connection, combined with practical considerations like favorable exchange rates and growing urban infrastructure, makes Indian real estate an appealing option for NRIs.

NRIs are increasingly turning to the Indian real estate market as a viable and attractive investment avenue. With the falling rupee enhancing their purchasing power and a growing preference for luxury and larger homes, NRIs are making significant strides in India's real estate sector, driven by both heartfelt ties and strategic financial decisions.

Is Latent Demand the backseat driver?

The nation’s population is projected to reach 1.55 billion by 2034, with 42.5% expected to live in urban centers. Latent demand refers to the unmet desire for a product or service that becomes apparent when market conditions change, such as through increased affordability, accessibility, or awareness. This urbanisation, coupled with a robust GDP growth that consistently outpaces most developed and emerging markets, creates a ripe environment for sustained real estate development across both residential and commercial segments.

Latent demand is playing a key role in this growth, as the expanding middle class and the rush to cities unleash previously untapped potential. Rapid growth is evident in various sectors, including co-working spaces, logistics, and residential real estate in Tier 2 and Tier 3 cities. The rise of flexible workspaces is meeting the needs of startups and large corporations seeking cost-effective office solutions. The logistics sector, buoyed by the e-commerce boom, continues to attract significant investment. Additionally, India’s youthful population, with a median age of around 28 years, ensures a steady and growing demand for housing.

So is India heading towards a bubble?

India's real estate market is experiencing remarkable growth, fuelled by a mix of demographic shifts, economic strength, and emerging sector trends. However, such rapid expansion and exuberant growth often come with their own set of risks.

Historically, surges in real estate investment and booming markets have occasionally led to bubbles—instances where asset prices are driven well above their intrinsic values due to speculative buying and exuberant market sentiment. The 2008 financial crisis, for instance, was partly precipitated by such a bubble in the real estate sector, where unsustainable growth and speculation led to a severe market correction. Similarly, China’s recent housing bubble has illustrated how unchecked growth can lead to economic instability.

So is India heading towards a bubble? We don’t think so. China’s housing bubble was driven by speculation, high borrowing, and weak regulation, resulting in unsustainable price surges. In contrast, India’s real estate growth is underpinned by solid economic fundamentals and strategic reforms. With a focus on transparency and affordability, these factors help mitigate the risk of India experiencing a similar situation.

Let’s take a look at what exactly what went wrong for China and how India can avoid a similar situation.

China’s Property Bubble: A Brief Examination

China’s real estate sector, once a powerhouse driving the nation’s rapid economic ascent, is now embroiled in one of the most severe housing crises in recent history. The crisis has unfolded with dramatic consequences, including a record debt-to-GDP ratio of 288% in 2023 and a significant downturn in housing activity. Property sales have plummeted by a third from their pre-pandemic peak, and new construction has dropped by 60%. This situation mirrors historical economic crises, such as Japan's post-1989 real estate collapse, which transitioned Japan from a high-growth economy to one with persistently low growth rates.

→The Roots of the Bubble

To understand why China’s real estate market has stumbled, we need to look back at its meteoric rise. In the late 1970s, under Deng Xiaoping's market reforms, China transitioned from a closed, centrally-planned economy to a global economic player. This transformation spurred explosive growth, especially in the real estate sector, where both locals and investors saw massive opportunities.

However, the rapidly built economic power‘house’ was built on a shaky foundation of debt. Developers, buoyed by easy credit, began borrowing excessively, leading to overbuilding and speculative investments. Local governments also got caught up in the frenzy, funding massive real estate projects to boost their prestige and revenues. The lack of robust regulation meant that risks were high and the system was vulnerable to a crash.

→The Bursting of the Bubble

Eventually, the bubble had to burst. The Chinese government introduced the "Three Red Lines" policy in August 2020, which aimed to clamp down on excessive borrowing by property developers. While this seemed like a step towards financial stability, it ended up leading to a sudden liquidity crunch for the Chinese real estate giants. Companies like Evergrande and Country Garden, once industry leaders, found themselves drowning in debt. Evergrande, for instance, defaulted on over $300 billion in liabilities, leading to its court-ordered liquidation.

The situation worsened as the market was flooded with unsold or partially constructed properties—estimates range from 50 to over 100 million units. Local governments are set to purchase unsold homes through state-owned enterprises, aiming to reduce the glut of properties and stabilise prices.

With so many empty homes and falling property values, the market entered a severe correction phase. The government’s attempts to stimulate the market—such as lowering down payment requirements and reducing mortgage rates—have been largely ineffective in turning things around. It will take a herculean effort to reinvigorate a market that is sagging under its own weight. These measures have failed to address the root causes of the crisis: excessive debt and overcapacity.

→Cultural and Economic Factors

China's cultural affinity for real estate as a safe investment, combined with a regulatory environment that incentivized property ownership, played a significant role in inflating the bubble. Real estate in China is more than just an economic asset; it is a cultural symbol of success and stability. The historical preference for property investment over alternatives like the stock market, coupled with inadequate tenant protections and a lack of social security, reinforced this trend.

→A Middle-Class Perspective: Dreams on Hold

Imagine the situation from the eyes of a middle-class family in a smaller city like Chengdu. For years, this family has saved diligently, dreaming of owning a home as a symbol of their hard work and success. They see real estate not just as an investment but as a key to their future stability. Now, with the market flooded with unsold properties and the dream of homeownership feeling more distant, their aspirations are put on hold.

Additionally, the government’s plan to buy up excess inventory sounds promising, but it faces serious hurdles. Excess properties are mostly concentrated in third-tier cities like Chengdu, where demand is weak. In contrast, cities like Shanghai and Beijing, with high demand, don’t have much surplus inventory. It’s like trying to fix a leaky boat with mismatched patches—no matter how many patches you apply, the leaks persist.

For a family hoping for affordable housing, these financial intricacies mean the dream might remain just that—an elusive hope rather than a tangible reality.

Conclusion: Navigating the Real Estate Landscape

India’s real estate market, with its vibrant growth and innovative policies, is undeniably exciting. The country is making strides with reforms like RERA and initiatives such as PMAY, which aim to boost transparency and provide affordable housing. The boom has sparked interest from Non-Resident Indians (NRIs) and driven investment in emerging cities. But let’s not ignore the hurdles—rising property prices in major cities are straining affordability, and regulatory compliance and project delays remain significant issues.

China’s property bubble, on the other hand, serves as a cautionary tale. Over-leveraging and speculative investments have led to a severe market downturn, highlighting the dangers of excessive debt and insufficient regulation. For India, there’s a clear takeaway: while rapid growth is tempting, it’s essential to balance it with careful oversight and sustainable practices to avoid the pitfalls that China has faced.

India’s journey is going to be a long one, and while its trajectory looks promising, it's crucial to address these challenges head-on. By learning from China's mistakes and continuing to strengthen its regulatory framework and infrastructure, India can steer its real estate market towards a resilient future.

So, as we look ahead, the key for investors, policymakers, and all stakeholders is to stay informed and adaptable. Embracing opportunities while being mindful of potential risks will be essential in navigating this ever-evolving landscape.

And just in case you missed out on the last edition of Deja Brew - we brewed something worth reading:

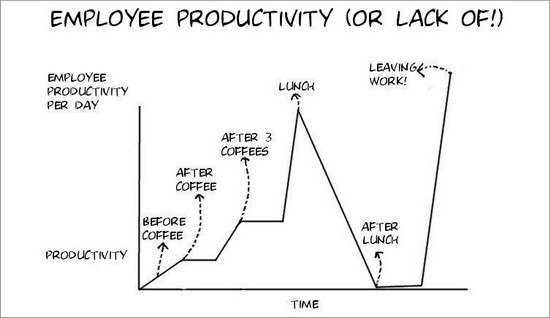

The Economics of Caffeine

From the first sip that kickstarts your morning to the growing industry that fuels millions worldwide, caffeine’s influence is far-reaching.

Well written